Why investments in ecosystems matter more than any industry investments

A constant battle for competitive advantage and market share across the global economic spectrum is slowly but surely leading to ongoing shifts in terms of industry consolidation, new and emerging business processes, and emerging non-traditional channels.

Innovative businesses, especially those operating in the digital space, see networks and ecosystems as an increasingly strategic area of focus. The question is why? What are these business ecosystems and why are they becoming more attractive to investors than industry verticals?

According to Adner and Kapoor (2009), the business ecosystem is a value-oriented network, composed of numerous stakeholders and represented by transactions between the stakeholders (Bertassini et all, 2021).

An article published in the Journal of Business Research (Gueler and Schneider, 2021) argues that “business ecosystems are an important form of inter-organizational cooperation and potential driver of a company’s success. Strong ecosystems strike a balance between their actors’ cooperative value contribution and competitive value appropriation.”

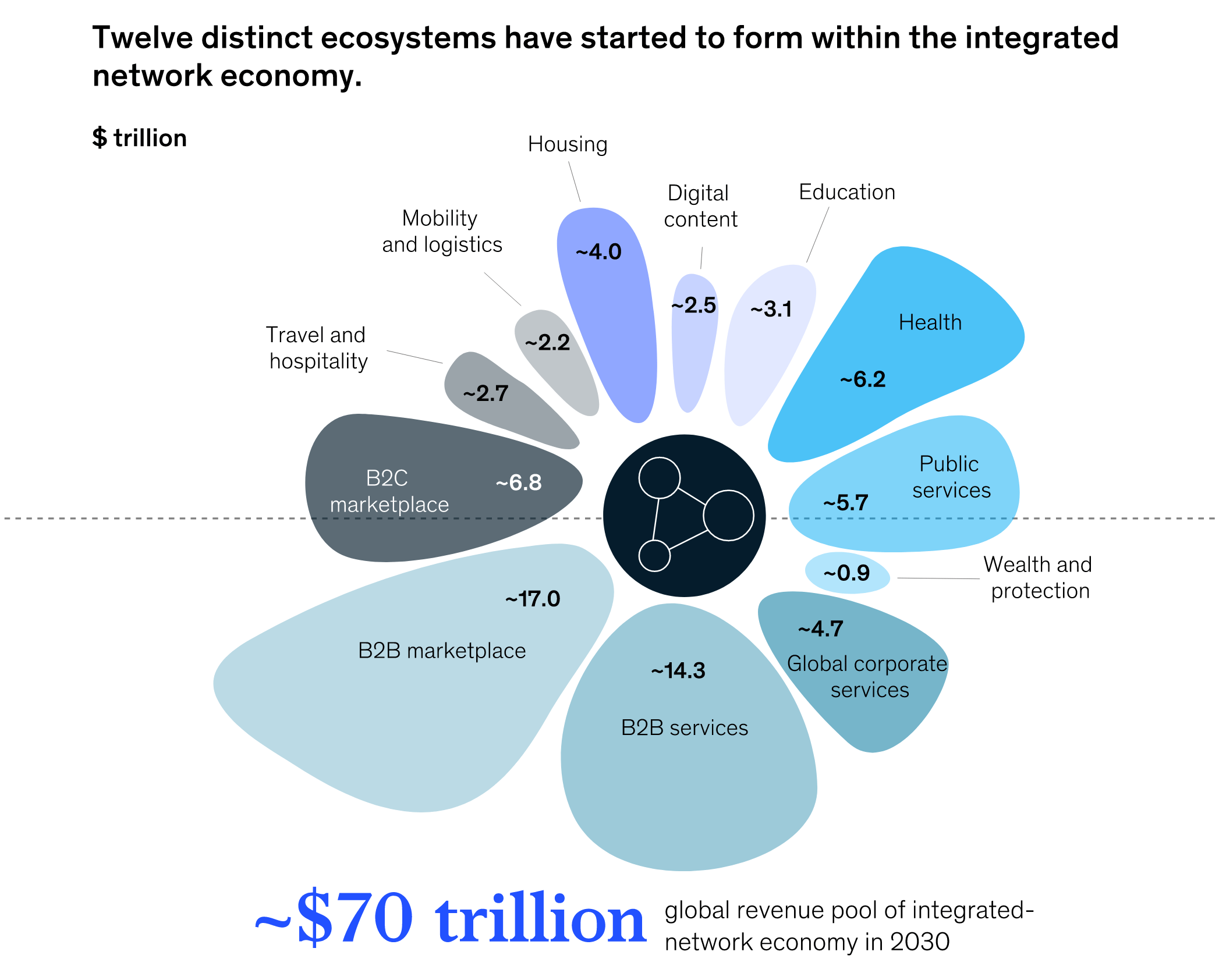

Additional research (Rong et al, 2021) suggests that in order to preserve sustainable innovation, work and collaboration between key ecosystem partners is a must, thus providing further credence to McKinsey’s latest research which argues that “by 2030 the integrated network economy could account for 25 percent of the total economy […] with global revenues of $70 trillion.”

Credit: McKinsey, 2021. A design-led approach to embracing an ecosystem strategy.

The paradigm shift in the global strategy of multinational enterprises towards business ecosystems is fundamental to the creation of corporate networks based on corporate capital relations. However, what is poignantly clear today is that creating collaborative value through business ecosystems is crucial to achieving a circular economy model.

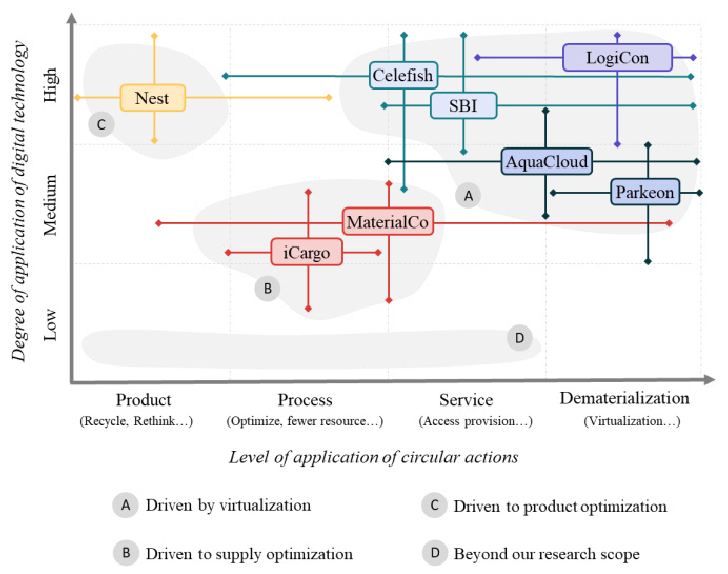

An area of academic research less explored until recently is that related to the link between circular economy and ecosystems structured by digital technologies. In this respect, the findings of a study presented at 2021 CIRP Design Conference (Trevisan et al, 2021) are compelling:

- Ecosystems can apply circular actions at four different levels according to various digital technologies’ degree of dependence.

- There are three drivers that conduct circularity in ecosystems associated with digital transformation: virtualisation, supply optimisation and product optimisation

- Distinct types of ecosystems adopt different strategies and, while the transaction type focus more on dematerialisation and providing access, solution ecosystems focus on optimising products and processes.

CREDIT: Trevisan et al, 2021. Circular economy actions in business ecosystems driven by digital technologies. Procedia CIRP, 100, 325-330.

Empirical evidence shows that companies implementing open innovation need several open networking capabilities (absorptive capacity, multiplicative capacity, and relational capacity) with suppliers, customers, higher education institutions, competitors, and others.

According to Ramezani and Camarinha-Matos (2019), as we move towards systems-of-systems composed of smart components with varying degrees of decision-making capabilities, of a distributed and socio-technical nature, there is also an increase in systems complexity and inter-dependencies.

In parallel with systems integration and hyper-connection, there is a growing focus on value chains and novel business models that leverage the collaborative potential among all the stakeholders involved.

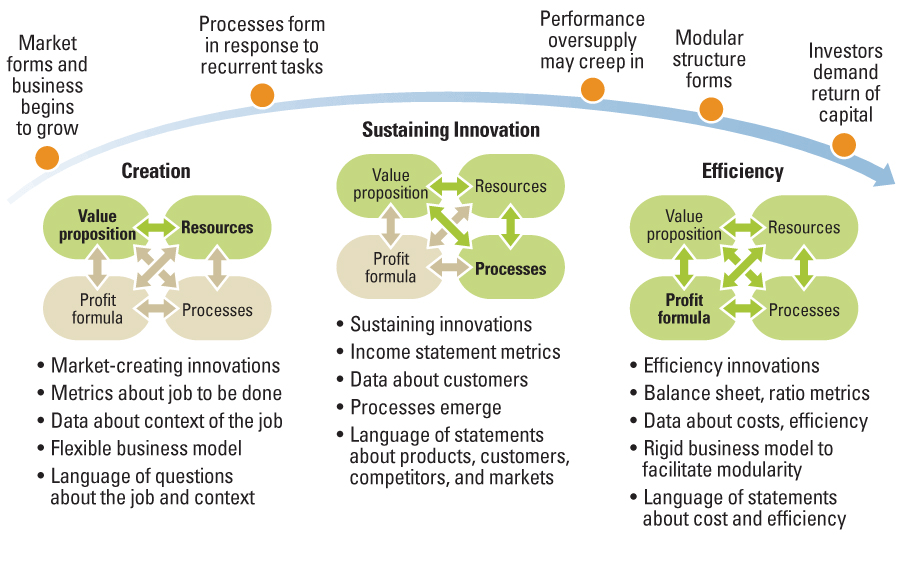

It should come as no surprise that, in a an aptly titled article - The Hard Truth About Business Model Innovation – published in MIT Sloan Management Review in 2016, the complexity surrounding networks and ecosystems requires constant configuration and revision:

Ecosystem investing is not a new concept. As early as 2015, a bold argument was being made in article published in Stanford Social Innovation Review: “ […] funders seeking impact at scale must view their work within the context of a broader ecosystem and adjust their behavior in response to change within that system.”

A question worth reflecting upon by many investors still focussed on industry verticals is the same question used as subtitle in a White Paper published by First State Investments: is the investment ecosystem ready to meet the needs of the next generation of investors?

Expectations may need to be set not only in what dedicated responsible investment funds can achieve but, also, in how they achieve it. Circular economy is not just an industry, but an entire ecosystem, and there can be no tangible and sustainable action without investors realising that they need to invest in ecosystems: what seems like a good idea is worth very little if it does not connect with other elements belonging to the value chain.

There is another critical point to make: investors should target companies that are part of the same technical ecosystem. For instance, to invest in a company that is cloud-based and has a microservices architecture, and then in another one in the same space - but one that has a layered architecture - will give the impression of no portfolio strategy.

Today, there are many start-ups that choose their investors: they have a strong product or service, the fill a gap on the market, or they solve a problem. Such start-ups are in high demand, and they never lack sources of investment – so, to be selected by such start-ups, investors need to offer more than just cash: they need to demonstrate that they have a very good understanding of the technical ecosystem of that start-up, and that their portfolio of investee companies is comprised of other start-ups that operate in the same ecosystem.

Main photo: Photo by Clint Adair on Unsplash