ESG ratings – trust but verify

Today, green credentials are the new fad of every up-and-coming business, let alone that of already established corporations. If there is an opportunity to turn the planting of a tree into a media spectacle, or the offsetting of poorly and environmentally damaging operations into ‘evidence’ of climate protection, we know that there are many businesses out there who are absolutely ‘delighted’ to highlight their so-called efforts.

Cynicism aside, not all corporates behave irresponsibly or outright lie – the way most of them release or publish their environmental and social governance (ESG) credentials does. And the reason they do so is very simple: because they can say anything they want since there is absolutely no one checking that they actually DO what they say.

A damning article recently published by Bloomberg runs with a brilliant headline: ‘The ESG Mirage’. It is a mirage, especially since the ESG ratings are an ‘unregulated piece of the business.’ Now let us discuss this in detail if we may.

The main difference between a desk top study (research) and an audit, for those who are not very familiar with these concepts, is that the former heavily relies on documents provided as ‘evidence’, and the latter heavily relies on ‘show me how you do it.’

There are many marketing and PR agencies out there, let alone a myriad of management consultancies, who produce stunningly good looking reports: from overall design and graphics, to a carefully chosen typeface. The slicker something looks, the more likely it is to be believed, bought, or appreciated – that is marketing psychology 101.

Similarly, there are many – too many – ‘Top 10 of This’ and ‘Top 100 of That’ whose research methodology and ranking systems are utterly laughable. Yet, when such annual reports/charts/tops are released, very few of us look for what actually really matters: the research methodology, i.e., how – among many other things – the data has been collected, analysed and interpreted. If the research methodology does not stand scrutiny and is not airtight, neither do the findings of such reports or their ‘rankings’.

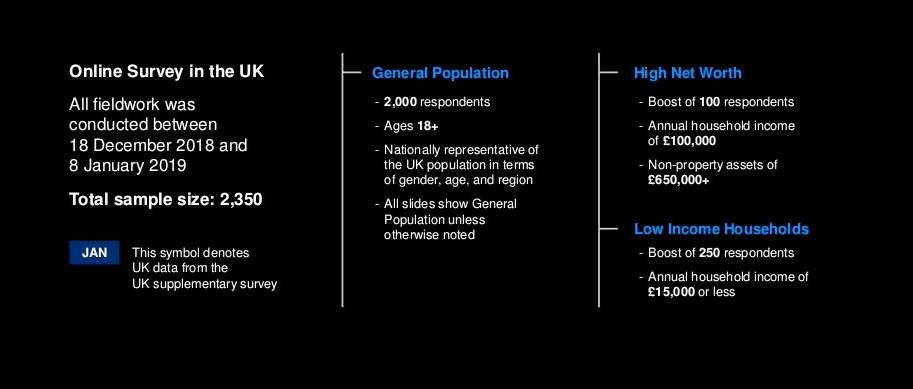

For instance, below is the research methodology of a report whose findings had been (sadly) taken at face value. The Report was released in 2019, and its findings were related to the UK’s energy sector:

To the untrained eye – or to those of you who are not very familiar with research methodologies – all this nicely and eloquently presented data may make you think that the report’s findings are absolutely solid. Are they, though?

Below are some of the missing points and qualifying questions that are missing from the ‘research methodology’ presented above, both of whom may have dramatically changed the said ‘findings’:

- Survey taken by only 2,350 people out of more than 66 million (that is 0.0035% of the country’s population!!!)

- What is the energy consumption pattern of those interviewed, other than their net worth/wealth?

- Do they use heating oil/gas or are they self-sufficient in terms of electricity generation (use solar panels, air-heat pumps, wind turbines etc.)?

- Do they work in the energy industry or have relatives working there (how has the research bias been eliminated from this survey)?

- Are the 2019 respondents different from the respondents surveyed in the previous years?

- What was the gender breakdown of the respondents?

- Where were the respondents residing (noting the fundamentally different energy consumption pattern across the UK)?

- What was the weighting of respondents from Northern Ireland versus that of the respondents in England/Scotland/Wales?

Now that we have, hopefully, shed some light on survey results, ‘top’ whatever and similar, let us return to the topic of ESG ratings.

A corporate brochure, a nicely designed annual report, or an even nicer corporate pledge do not constitute a rationale for awarding a rating. Corporates’ ability to create words and pictures is not directly proportional with their ability (let alone willingness) to turn words into actual actions, but to the size of the budget they can afford to allocate for such ‘creative processes’. They are just words.

To rate any business based on its ‘words’ and ‘pledges’ is – and please forgive us – simply irresponsible, let alone unethical and even stupid. If this were the case, the ratings should be actually given to the designers, speechwriters, and PR staff! They are the actual creators of those words, aren’t they?

As a society, as businesses operating in the 21st century, as corporates committed to abiding by the circular economy principles and by those set out in the United Nation’s SDGs, we should not be satisfied with the rating of words, but with the rating of actions.

How many of the current rating outlets send their own writers - how many of these actually employ trained and specialist (as in competent and qualified for that industry) auditors? – in the field, to check that the words on paper are applied to the daily operations of those they rate, and that tangible ESG actions are being taken on the ground?

There is an old saying which should apply to any and all such ratings, ESG ratings in particular: trust but verify. We still live and work in a linear business environment, one that is putting vacuous pledges and commitments on a pedestal. Net-zero commitments, climate change pledges, multi-lateral agreements and similar are another suite of examples pertaining to the same issue.

Technology can solve the trust issues, and blockchain can serve this purpose. When companies manage their supply chain with blockchain, ESG reporting becomes real: it is verifiable and trackable, and it can use real-time data.

The problem is that these empty and unsubstantiated claims are affecting us all, as both people and professionals: we no longer trust, we no longer believe. When we do not trust nor believe, we lose interest. And when we lose interest, we allow empty and unsubstantiated claims to exist – and we should not.