The Right Investors for Your Startup

Knowing whose door to knock on when you need some pre-seed, seed or scale-up money can save you a lot of time and, also a lot of money.

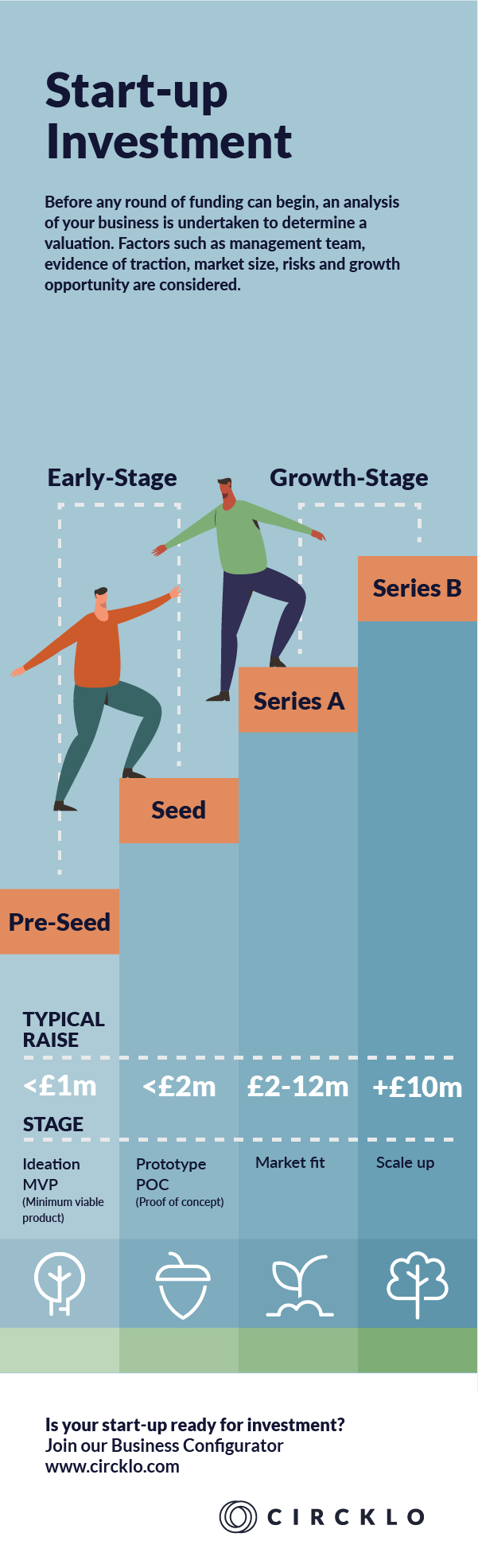

Every growth phase in the life of a start-up can be fully matched to a type of investor. For instance, in your pre-seed stage you are much more likely to secure some funds from either a business investor (also known as an ‘angel investor’) or a family friend or, depending on the extent of your network, a family business.

Angel investors usually fund very small tickets: start-ups which are in the ideation phase, are still looking to find their feet and see if their business idea makes sense or not. If you need up to £100,000 in pre-seed funding, an angel investor may be the fastest and easiest option for you to secure that much needed seed capital.

There are, again depending on what you are trying to do and the profile of the angel investor you approach and how well-connected you are, business angels who can even go up to £1 million. Usually, for that size of a pre-seed or even seed investment, they are highly likely to want a significant level of equity in your start-up, just to secure their return.

If, and this all depends on your risk appetite and your exit strategy from the business you’ve just set-up, you are looking for anything above and including £500,000, you’d be better off pitching your idea to a Venture Capitalist (VCs). VCs are usually willing to fund anything less than £10 million in exchange for equity and seek to multiply their internal rate of return (IRR) – this is an estimation of the profitability of any potential investments they make.

Generally, VCs are not interested in acquiring your business, nor in being with you – as in, involved with your business – longer than their IRR is recovered. They can be very useful board members, you can and should definitely rely on their network and advice: they are primarily there to protect and grow their investment in your business. Hence, it is in their best interest to ensure you have all the support you need to scale, and scale fast.

Private Equity (PE) funds are not generally interested in investing in start-ups, on the contrary. They mostly invest in public businesses (as in listed) which they seek to take over and absorb – add to – their fund portfolio. As a minimum, any PE fund would be looking at 15% IRR and then full ownership of the business.

It helps to know what investor is right for you and which type of investor would be willing to talk to you. You do not have the time – and highly likely you do not have the resources – to knock on doors which will remain closed to you for a while.

If you understand where you fit in, what value – financially speaking – you can offer any type of investor, what sort of exit strategy you have considered for yourself as a start-up (co)founder, then you are on a winning streak.

Circklo’s Business Configurator is solely dedicated to sustainable start-ups. We help you configure your start-up for both profit and purpose and, after 12 modules of intensive business coaching, mentoring, dry-pitching, and networking with industry experts, angel investors, venture capitalists and other start-ups in the community, you will see the enormous difference we make to your business: we optimise your business to be investment-ready.

Join our Business Configurator to scale-up your product, and be confident about what it can deliver to your customer base. Apply now