Being a sustainable start-up is not enough to secure investment

Until recently, the world we live in was completely blind to sustainability and environmental issues. These were only nice and lofty aspirations and missions, not actionable, tangible and potentially profit-generating business ideas.

Earlier this week, our members-only Gamechangers community had a meeting with Marco D’Attanasio PhD, a serial investor and private equity fund manager, and Chief Investment Officer at Hadron Capital.

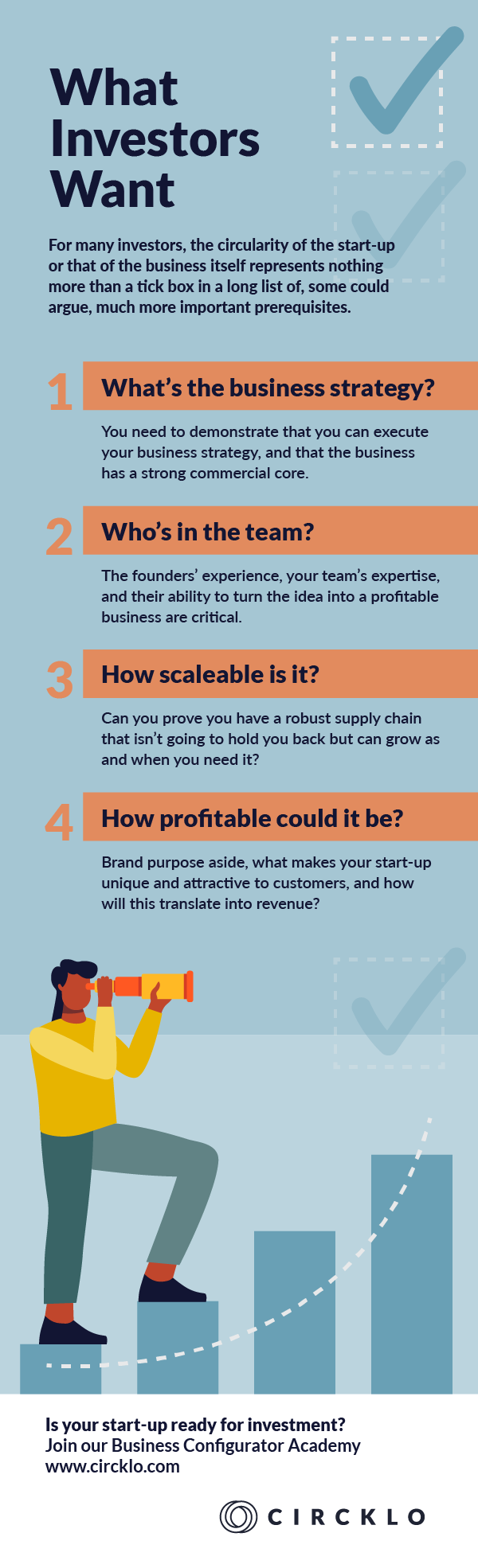

In Dr D’Attanasio’s view, investing in a circular economy business is not different at all from investing in a non-sustainable, or regular, business – for many investors, the circularity of the start-up or that of the business itself represents nothing more than a tick box in a long list of, some could argue, much more important prerequisites.

Hundreds of thousands of circular economy start-ups are focussing only on the bigger picture, and, in the view of investors, such an approach is counterproductive. “Saving the planet” is a purpose, not a profit generating venture.

Sustainability and circularity are admirable and much needed pursuits and, while investors appreciate the ethos behind the business, to secure that much needed investment to scale up, start-ups need to be able to tell potential investors how the business is being run, who runs it and, most importantly, what the activity of that business really is about.

Tens of billions of private equity and venture capital funds are available today to climate-tech businesses and start-ups. In the first week of August 2021 alone, TPG landed $5.4 billion in funding for the first close of its new Rise Climate Fund, and Brookfield announced the initial closing of a $7 billion climate-focused fund that has a goal of achieving a net-zero carbon economy (Pitchbook, 2021).

While more and more investments are made available to circular and sustainable tech, the “mortality rate” of new businesses is extraordinary and, according to Dr D’Attanasio, “being a sustainable or circular start-up makes your odds of success even lower because you start from a position of weakness”.

What any sustainable or circular start-up must do is simple yet daunting to comprehend for many: they need to convince investors that they can execute their business strategy, and that the business they have set up has a strong commercial core.

A sustainable/circular business is just a business – solving an environmental problem is not a business, in and of itself, unless profit is generated.

An aspect which is often overlooked by many circular start-up founders is their supply chain – how reliable it is, and how easy it is to consolidate. Without a strong supply chain, no start-up can prove its ability to scale up.

Investors focus much more on the core team of the start-up than on the business idea. The founders’ experience and expertise in that area, their team’s knowledge of the market the idea wants to serve, and their ability to execute and mitigate all potential risks associated to turning that idea into a profitable business, are critical to securing investment.

Most sustainable and circular start-ups begin their journey at an already potential competitive disadvantage due to the current supply chain difficulties. For investors, the uncertainties related to investing in sustainable/circular start-ups are huge, even more so since it is unrealistic to expect a sustainable start-up, or even business, to become profitable as quickly as a regular one.

Being circular is a challenge in terms of raising money, and it can be argued that, from the perspective of raising private equity, it would be rather detrimental for a start-up to focus only the problems they are trying to solve - they should focus on what makes them unique, on their team strength and on their revenue pipeline.

Given that, currently, there is no mature sustainable supply chain, tech start-ups operating in the sustainable and circular space are, in theory, more attractive for investors since the risks for such a business would be minimal. The investor prize pot is very high for sustainable businesses that can make it.

Circklo’s Business Configurator is solely dedicated to sustainable start-ups. We help you configure your start-up for both profit and purpose and, after 12 modules of intensive business coaching, mentoring, dry-pitching, and networking with industry experts, angel investors, venture capitalists and other start-ups in the community, you will see the enormous difference we make to your business: we optimise your business to be investment-ready.

Join our Business Configurator to scale-up your product, and be confident about what it can deliver to your customer base. Apply now